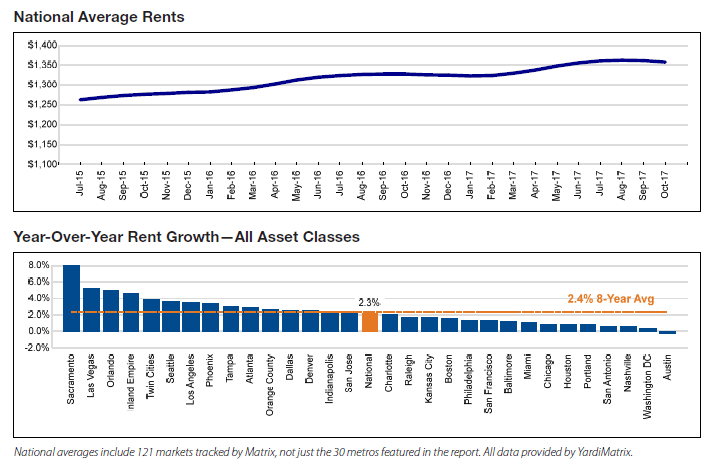

The average U.S. monthly rent fell by $4 in October, down to $1,358, according to the most recent Yardi Matrix Matrix Monthly survey of 121 markets. Rent growth fell to 2.3% year over year (YOY) during the same period, down 30 basis points (bps) from September.

This drop reflects a number of seasonal and cyclic factors. For one, rent growth tends to slow at the top of the fourth quarter, and the multifamily market is cooling down on the whole from its cycle high in 2016. And the national monthly rent is only $5 lower than its all-time high, in August, and is currently $30 higher than it was one year ago.

On the metro level, Sacramento, Calif., still sports the fastest rate of rent growth, at 7.9%, a full 260 bps higher than Las Vegas, which has recently taken second place, at 5.3%. Seattle (3.7%) has fallen from second to sixth place, reflecting a wider trend of deceleration in the Pacific Northwest. Yardi attributes this decline to the region’s glut of luxury units.

October also marks the first month in which the Matrix Monthly report has been able to measure the aftereffects of Hurricane Harvey on the Houston market, which hasn’t experienced positive YOY rent growth since July 2016. Rent growth in Houston is now up to 0.8% YOY through October 2017, a 100 bp rise over the metro’s -0.2% rate in September. Yardi notes that over 45,000 apartment units and 100,000 housing units in the Houston market are still “out of commission” because of the hurricane.

Occupancy remained unchanged from August to September, at 95.6%, despite the still-steady stream of new supply entering the market. (Matrix Monthly’s occupancy data are current to the previous month.)

Lifestyle-unit occupancy remains at 95.3%, 50 bps behind the renter-by-necessity (RBN) unit occupancy of 95.8%. Lifestyle units are generally high-end properties rented by households with enough wealth to own, whereas RBN units serve households that cannot own given their circumstances or finances.

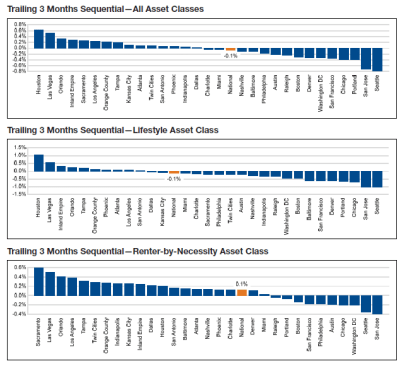

On a trailing three-month (T-3) basis, which compares the past three months with the previous three months, the national rate of rent growth fell 0.1%, to -0.1%, in October, after remaining flat in September. A number of metro markets have posted negative rent growth on a T-3 basis, including Seattle (-0.8%); San Jose, Calif., (-0.7%); and San Francisco (-0.4%). All of these markets experienced strong rent growth during the summer but have retreated in recent months.

Houston was one of the fastest-growing markets on a T-3 basis this past period, with a 0.6% increase in rent. Yardi attributes this rise to an increased need for temporary housing in the wake of Hurricane Harvey. Other strong performers include Las Vegas (0.5%) and Orlando, Fla., (0.3%). The Orlando market’s rent may continue to grow as some Floridians and Puerto Ricans relocate following hurricanes Irma and Maria.

Looking at the T-3 numbers by asset class, Houston experienced the strongest lifestyle rent growth, at 1.0%, and Seattle saw the largest T-3 lifestyle rent-growth decline, at -1.0%. Sacramento topped RBN growth, at 0.6%. At the national level, workforce housing rent increased 0.1%, while high-end rents declined 0.1%.

On a trailing 12-month (T-12) basis, rents grew by 2.8% on the national level in October, down 20 bps from September. A significant gulf between RBN rent growth (4.1%) and lifestyle rent growth (1.7%) remains on a T-12 basis.

Sacramento leads the nation in T-12 rent growth, at 9.6%, followed by the Inland Empire, at 5.7%, and Seattle, at 5.5%. Houston remains the only top 30 metro with negative rent growth on a T-12 basis (-1.7%) but is expected to rebound in the coming months. San Jose (0.7%) and Austin, Texas, (0.9%) also rank near the bottom. Yardi notes that Austin is experiencing short-term supply shortages, while San Jose has an issue with affordability.